Keep Ahead of the Contour: Offshore Company Formation Basics

Keep Ahead of the Contour: Offshore Company Formation Basics

Blog Article

Everything You Need to Understand About Offshore Firm Development

Navigating the complexities of overseas business formation can be a complicated task for many people and organizations seeking to broaden their operations worldwide. The allure of tax obligation benefits, property defense, and raised privacy often attracts rate of interest towards developing offshore entities. Nevertheless, the detailed internet of legal requirements, regulatory structures, and financial considerations can posture considerable challenges. Recognizing the nuances of overseas company development is essential for making educated decisions in a globalized service landscape. By deciphering the layers of advantages, challenges, actions, tax obligation ramifications, and conformity obligations related to offshore business development, one can gain a detailed understanding into this diverse topic.

Advantages of Offshore Firm Development

The benefits of establishing an overseas business are multifaceted and can dramatically benefit individuals and companies seeking calculated economic preparation. One vital benefit is the potential for tax optimization. Offshore companies are frequently subject to beneficial tax policies, enabling for minimized tax obligations and boosted revenues. Furthermore, establishing an offshore company can provide asset defense by dividing individual possessions from service obligations. This separation can safeguard individual wide range in the occasion of legal disputes or financial challenges within business.

In addition, overseas companies can facilitate global service operations by giving accessibility to global markets, diversifying earnings streams, and improving business credibility on a global scale. By establishing an overseas presence, organizations can use brand-new opportunities for development and growth past their domestic boundaries.

Typical Difficulties Faced

Despite the numerous advantages linked with offshore company development, individuals and businesses often encounter usual difficulties that can affect their operations and decision-making procedures. One of the primary obstacles dealt with is the complexity of global guidelines and compliance requirements. Browsing varying lawful frameworks, tax obligation legislations, and reporting standards throughout different jurisdictions can be daunting and taxing. Making certain full compliance is critical to stay clear of economic fines and lawful problems.

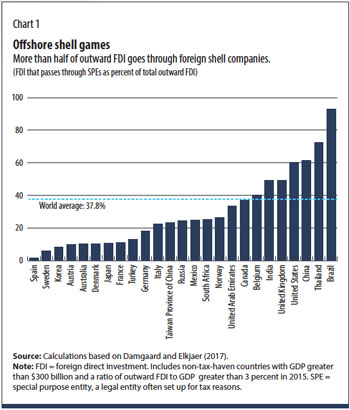

Another typical obstacle is the threat of reputational damage. Offshore business are occasionally seen with skepticism due to worries concerning tax evasion, money laundering, and lack of openness. Taking care of and mitigating these understandings can be difficult, specifically in an increasingly inspected worldwide organization setting.

Furthermore, establishing and maintaining efficient interaction and oversight with overseas procedures can be testing as a result of geographical ranges, cultural differences, and time zone disparities. This can lead to misunderstandings, delays in decision-making, and problems in checking the efficiency of overseas entities. Getting rid of these obstacles calls for mindful preparation, attentive threat monitoring, and a detailed understanding of the governing landscape in overseas jurisdictions.

Steps to Type an Offshore Firm

Developing an overseas firm entails a series of lawfully compliant and critical actions to make sure a smooth and effective development process. The initial step is to select the offshore jurisdiction that ideal fits your service requirements. Factors to consider consist of tax obligation policies, political stability, and online reputation. Next off, you need to select an ideal business name and ensure it abides by the guidelines of the chosen territory. Following this, you will need to involve a registered representative who will aid in the consolidation process. The 4th step entails preparing the needed documentation, which commonly consists of articles of unification, shareholder details, and director information. When the documents prepares, it requires to be submitted to the pertinent authorities in addition to the requisite charges (offshore company formation). After the authorities approve the application and all charges are paid, the company will certainly be formally registered. Ultimately, it is vital to comply with continuous coverage and compliance demands to maintain the try this website great standing of the overseas company.

Tax Effects and Considerations

When forming an offshore company,Tactically navigating tax ramifications is important. Among the main factors people or services select overseas business development is to gain from tax advantages. Nevertheless, it is vital to conform and comprehend with both the tax laws of the offshore territory and those of the home nation to make sure lawful tax optimization.

Offshore companies are often based on desirable tax obligation routines, such as reduced or no business tax prices, exceptions on specific sorts of revenue, or tax obligation deferral choices. While these benefits can cause considerable savings, it is necessary to structure the overseas business in such a way that straightens with tax obligation laws to stay clear of prospective legal concerns.

Furthermore, it is vital to take into consideration the ramifications of try this site Controlled Foreign Corporation (CFC) regulations, Transfer Prices regulations, and various other international tax obligation legislations that might affect the tax obligation treatment of an overseas business. Inquiring from tax obligation experts or consultants with proficiency in overseas taxation can assist browse these complexities and make certain compliance with pertinent tax guidelines.

Managing Conformity and Rules

Navigating via the intricate web of conformity requirements and guidelines is essential for making sure the smooth operation of an overseas firm, particularly due to tax obligation implications and considerations. Offshore territories often have particular regulations governing the formation and operation of business to stop money laundering, tax evasion, and various other immoral tasks. It is essential look at these guys for business to remain abreast of these laws to avoid hefty fines, legal problems, and even the opportunity of being closed down.

To manage compliance successfully, overseas companies should select well-informed experts who comprehend the regional regulations and international standards. These professionals can assist in establishing correct governance structures, maintaining exact economic records, and submitting required records to regulatory authorities. Regular audits and reviews need to be performed to make certain continuous conformity with all appropriate laws and policies.

Moreover, staying educated regarding changes in legislation and adapting strategies accordingly is vital for long-lasting success. Failure to follow regulations can stain the credibility of the firm and result in serious repercussions, highlighting the significance of focusing on conformity within the offshore business's functional framework.

Final Thought

Finally, overseas company formation offers various benefits, but likewise includes difficulties such as tax obligation ramifications and compliance requirements - offshore company formation. By complying with the needed actions and thinking about all elements of developing an offshore company, services can make use of international opportunities while managing threats properly. It is very important to remain notified regarding regulations and remain certified to make certain the success and long life of the overseas company venture

By unraveling the layers of benefits, challenges, actions, tax effects, and compliance commitments connected with overseas business development, one can acquire a comprehensive understanding into this diverse topic.

Offshore business are often subject to positive tax guidelines, allowing for minimized tax obligation liabilities and raised profits. One of the main factors individuals or services decide for offshore business development is to benefit from tax benefits. Offshore jurisdictions typically have details laws regulating the development and operation of business to stop cash laundering, tax evasion, and other illegal tasks.In conclusion, offshore business development supplies various benefits, however additionally comes with obstacles such as tax implications and compliance demands.

Report this page